Online financial cybercrimes encompass a range of activities that involve unauthorized access, sabotage, or manipulation of computer systems with the intent to cause financial gain for the cybercriminals or financial loss for the victims. With the proliferation of the internet and mobile banking, these types of fraud have been on the rise. Here are various cybercrimes categorized under online financial fraud:

- Business Email Compromise/Email Takeover: This involves criminals gaining unauthorized access to a business email account and using it to deceive employees, customers, or business partners into making fraudulent financial transactions.

- Debit/Credit Card Fraud/Sim Swap Fraud: Criminals obtain unauthorized access to debit or credit card details or perform sim swap fraud to take control of a victim’s mobile number, allowing them to carry out fraudulent transactions.

- Demat/Depository Fraud: Fraudulent activities related to demat accounts and depository services, such as unauthorized trades, account takeovers, or manipulation of shareholding records.

- E-Wallet Related Fraud: Fraudulent activities involving mobile e-wallets, including unauthorized access to e-wallet accounts, phishing scams, or fraudulent transactions.

- Fraud Call/Vishing: Criminals make fraudulent phone calls pretending to be representatives of banks, financial institutions, or government agencies to deceive victims into revealing sensitive financial information or performing unauthorized transactions.

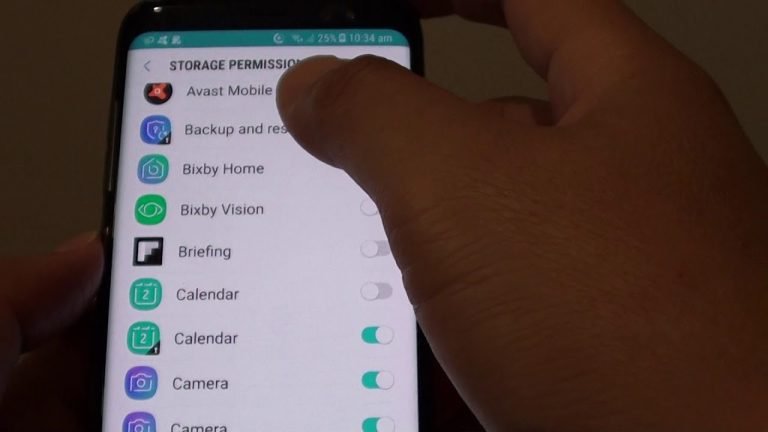

- Internet Banking Related Fraud: Fraudulent activities targeting internet banking platforms, such as unauthorized access to accounts, phishing attacks, or malware-infected transactions.

- UPI Fraud: Fraudulent activities involving Unified Payments Interface (UPI) transactions, including unauthorized access to UPI accounts, phishing scams, or fraudulent fund transfers.

These categories represent some of the common online financial frauds that individuals and businesses may encounter. It is essential to stay vigilant, practice secure online behaviors, regularly monitor financial transactions, and report any suspicious activities to the relevant authorities or financial institutions. Employing strong security measures, such as two-factor authentication, using secure networks, and keeping software and devices updated, can also help protect against these types of cybercrimes.